85

MAYBANKSustainabilityREPORT2013

OURPRODUCTSANDSERVICES

focusoncustomers

Our priority is to make it simple and easy for our customers to do business with us by paving the path for accessibility

and service. We will continue to improve efficiencies and synergies with the Group supported by our branch

transformation and improvements in customer service.

Service Quality (SQ) aligns with other units within Maybank worldwide to consistently deliver best-in-class customer

service moments. We play a pivotal role in streamlining customer service strategies and gearing towards operational

excellence. In 2013, we embarked on a centralised IT shared service, the Maybank Shared Service (MSS). MSS is aligned

with the Group’s strategic priorities to deliver better and improved customer services and control. We believe that

with MSS, we will be able to push delivery of customer service in a more seamless manner and are beginning to see

the results of our transformation. The annual External Customer Engagement Survey (ECES) was held in November and

December 2013 to gain insights on key indicators of Customer Engagement, identifying and prioritising service-related

areas. Overall we achieved a 46% engagement rate, a slight decrease from 2012’s 48%, as we faced system instability

challenges at our branches. The overall satisfaction score with our centralised problem resolution also recorded an

improvement from 2013, with staff’s product knowledge, attitude and services being the most favoured elements of our

service recovery.

We project that the overall satisfaction score with the centralised problem resolution will continue to see improvement

due to our staff’s knowledge in policy and procedure, as well as mannerism in handling complaints with quality of

resolution being our strongest points.

In order to engage better, we are also seeing the results from Project GIFT ‘Get Involved and Follow Through’ that was

introduced in July 2012. Project GIFT was introduced to improve end-to-end problem resolution by centralising complaints

handling with the Customer Feedback and Resolution Management (CFRM) team acting as a single point of contact

to relentlessly follow through problem resolution. In May 2013, more business units have been included in this Target

Operating Model (TOM) to reinforce efficiency and consistency in managing customer feedback.

Going the Extra

Mile

Madam Lee Guat Ee was at a lost on

how to transfer authorisation from her

husband to herself when her husband’s

delicate health made it difficult for him

to physically visit the bank. She called

Cards Authorisation to seek for assistance

and was attended by Brian Alcantra

who patiently listened and empathised

with Madam Lee’s situation, and offered

professional advice. Determined to see

the case through, Brian and the Head of

Maybank Call Centre, Audra Pinto, found

that the best solution was to visit Madam

Lee. Together, they dropped by her home

and took the necessary steps to assist

Madam Lee who was delighted with their

positive support.

An elderly customer visited the Maybank

TAR Branch in Kuching, Sarawak hoping to

make a simple remittance to her daughter

in Australia. The customer came in at 4pm,

close to the bank’s closing time, without

being aware that because the amount

was quite large additional information

was required for the purpose of the

transaction. Given the large amount, the

branch staff prepared an agreement letter

for the transaction and ensured that the

entire process was completed although

they were passed beyond closing hours.

The customers gratitude earned the

branch team a spot in the Heartbook.

46%

rateof

customer

engagement

7.5K

messages on

project

Heartbook

CustomerAppreciationthroughProjectHeartbook

Project Heartbook was introduced in 2013 as a social media tool to show appreciation and recognise contribution.

Heartbook evolved from project e-555, which is primarily an internal portal to recognise internalisation of core values.

Heartbook also functions as a learning channel for improvement at a professional and personal level. To date, over

7,500 messages have been received by both internal and external customers. As the project is taken to a regional level,

more messages are expected. Our branches, in particular, are seen as community leaders and participate actively in

local community events. In an effort of becoming the undisputed local market leader, they are more empowered now to

seize business opportunities, meeting the needs of our target segments to deliver the enhanced customer experience

and value proposition.

OurCommitment

2011

2012

2013

Progress

Improving customer

satisfaction which is tied

back to performance

improvement. (programme

initiated in 2012)

n/a

95%

98.4%

We have exceeded our initial

target of 90% and are working

to expand GIFT as a core

element of customer support

across the region.

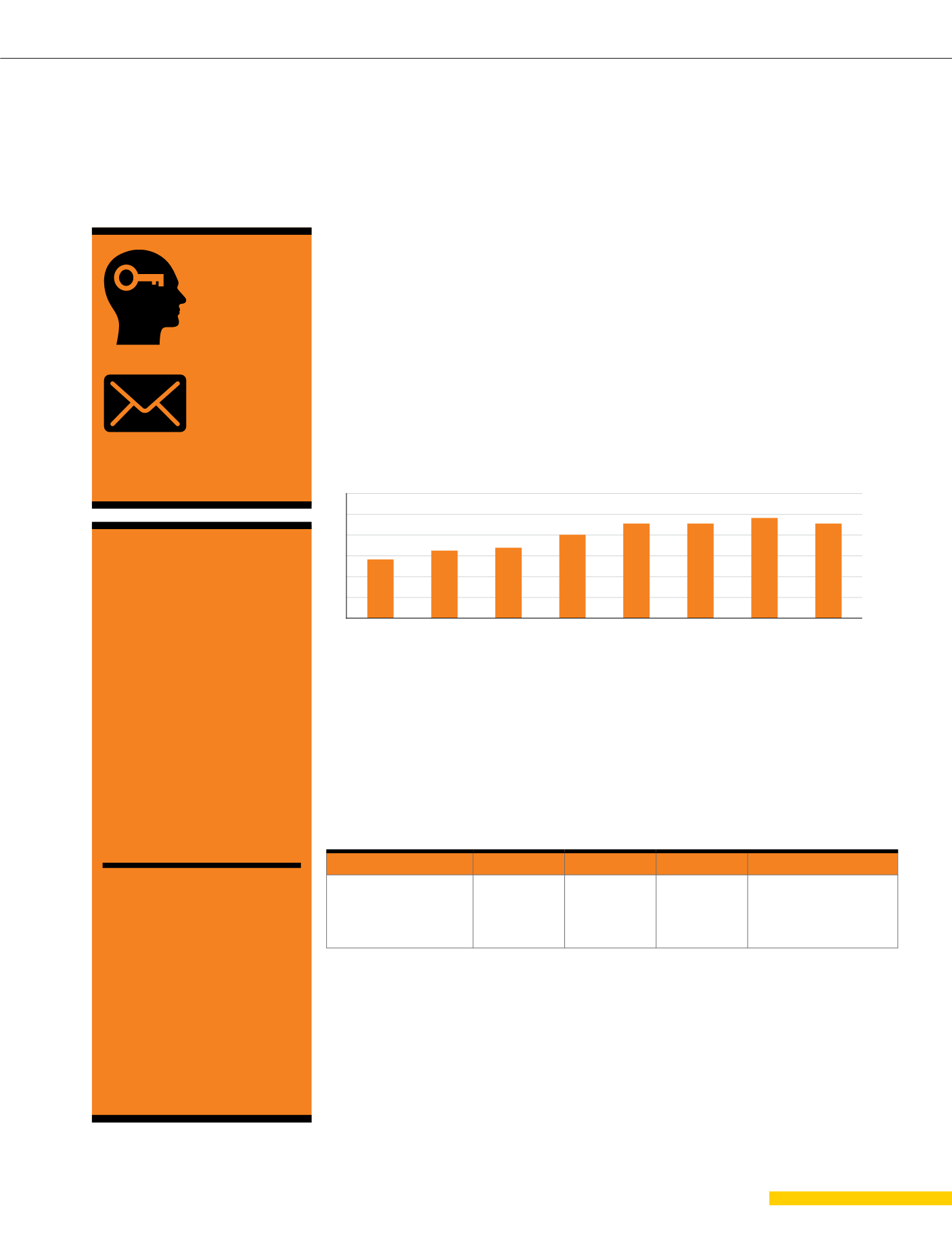

60

50

40

30

20

10

0

2008

2009

2010

2011

(Full)

2011

(1)

2012

(Half-year)

2012

(Full-year)

2013

29%

33%

MAYBANK EXTERNAL CUSTOMER ENGAGEMENT SURVEY (ECES)

34%

40%

46% 46% 48% 46%

ECES

G4-PR3, G4-PR5