84

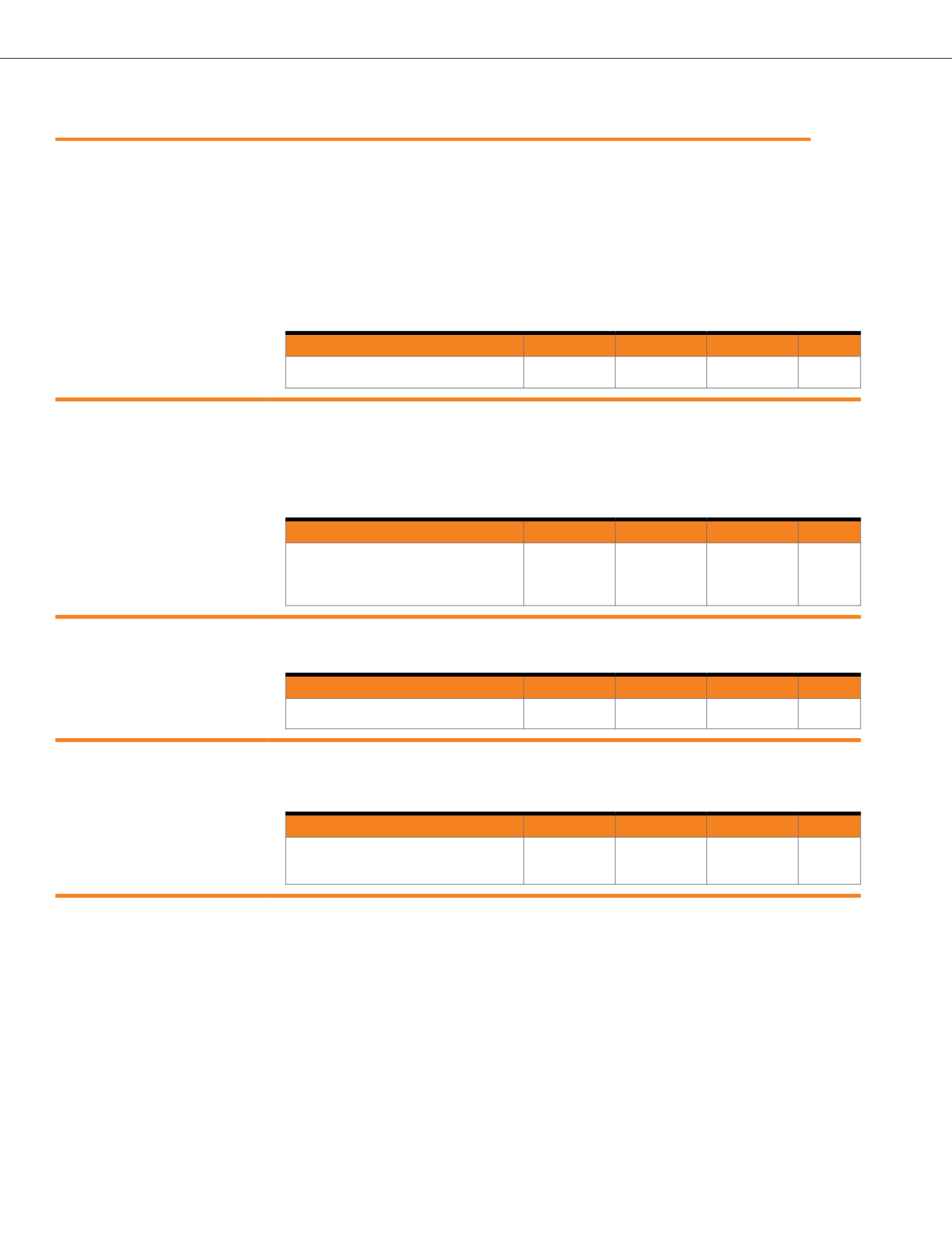

FocusonCustomers

Providing the best in customer service

and building mutually beneficial long-

term relationships.

• Going the extra mile

• Responsible marketing and communication

2011

2012

2013

Progress

Resolution of customer complaints through GIFT

(programme initiated in 2012)

n/a

95%

98.4%

•

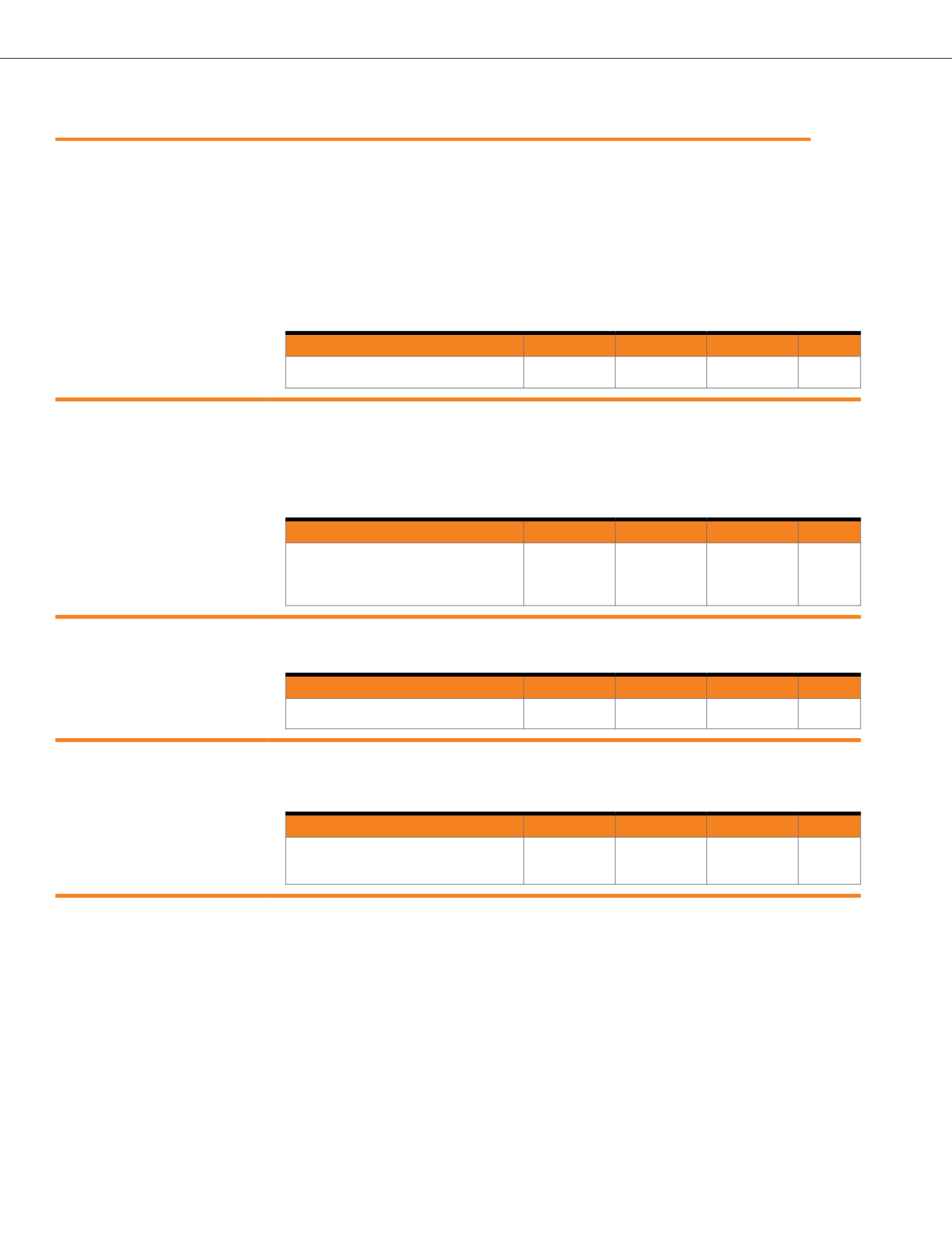

AccesstoFinance

Understand the interaction of social

issues and financial products to develop

effective and affordable solutions for the

community.

• Growing our reach — multiple touchpoints

• Branch transformation

• Reaching the underbanked

• Supporting customers in difficulty

• Microfinance

• Support for small businesses

• Supporting escalating costs of living

2011

2012

2013

Progress

Maybank One: A bundled product that assists

the lower income segment to familiarise and

benefit from financial products via kiosks

(programme initiated in 2012)

n/a

33 kiosks

44 kiosks

•

Our Digital Footprint

Technology has enabled us to fulfil the

increasingly complex requirements of a

growing sophisticated customer base.

• Looking into the future

• Information technology

• Data Protection, Privacy and Security

2011

2012

2013

Progress

Online access

20,722,590

M2U active users

24,038,016

M2U active users

28,819,658

M2U active users

•

ProductStewardship

Leadership in responsible lending

and addressing risks arising from

environmental, social and governmental

(ESG) issues are key to meeting our

sustainability commitments.

• Investment banking and advisory

• Green and renewable energy project finance

• Leadership in Islamic Finance

• Procurement sustainability

2011

2012

2013

Progress

Maybank2u Planner assisting registered users in

Financial Planning (programme initiated in 2012)

(cumulative)

n/a

42,817 users

83,714 users

•

ourapproach

In our 53 years, we have focused on going the extra mile to provide access to those who were not being served by any other financial institution. Our commitment is based

on three key principles: advising customers based on their needs, providing people with access to funding and being at the heart of the community.

We believe every action and decision we take must contribute to humanising financial services. In practice, this means we aim to enable access to banking and financial

services for all segments of society. As our business grows, we contribute to the region’s prosperity. Responsible growth means stewardship in promoting financial services

and products.

As an industry, we are also exposed to additional impacts through the companies we finance. Being custodians of public funds, the banking sector is constantly under

scrutiny. We are committed to having deep knowledge of our clients’ businesses, including understanding their social and environmental impacts. At the same time, we

believe that our business will only thrive when embedded with elements of good governance, social innovation and environmental integrity. For us, leadership in the

marketplace is defined by this strategically oriented mindset.

progressandpriorities

OUR PRODUCTS AND SERVICES

•

On track

•

Progressing

•

Not on track