12

FINANCIALHIGHLIGHTS

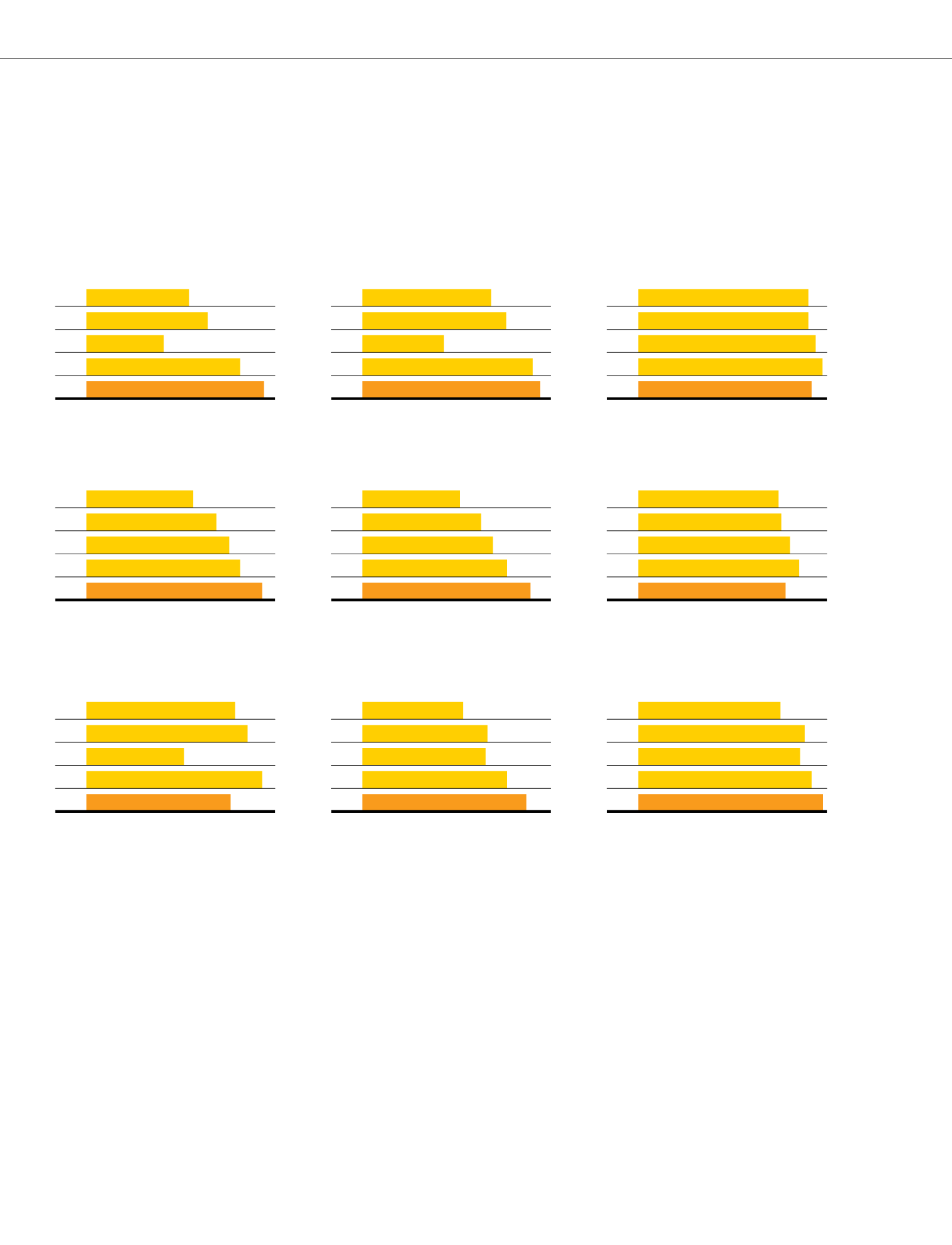

Profit Attributable to

Equity Holders of the Bank

RM6.55 billion

Earnings Per Share

75.8 sen

Return on Equity

15.1 %

3.82

4.45

2.59

5.75

6.55

53.9

61.4

34.5

72.7

75.8

FY10

FY11

FP11 *

FY12

FY13

FY10

FY11

FP11 *

FY12

FY13

FY10

FY11

FP11 *

FY12

FY13

14.5

14.5

15.2

16.0

#

15.1

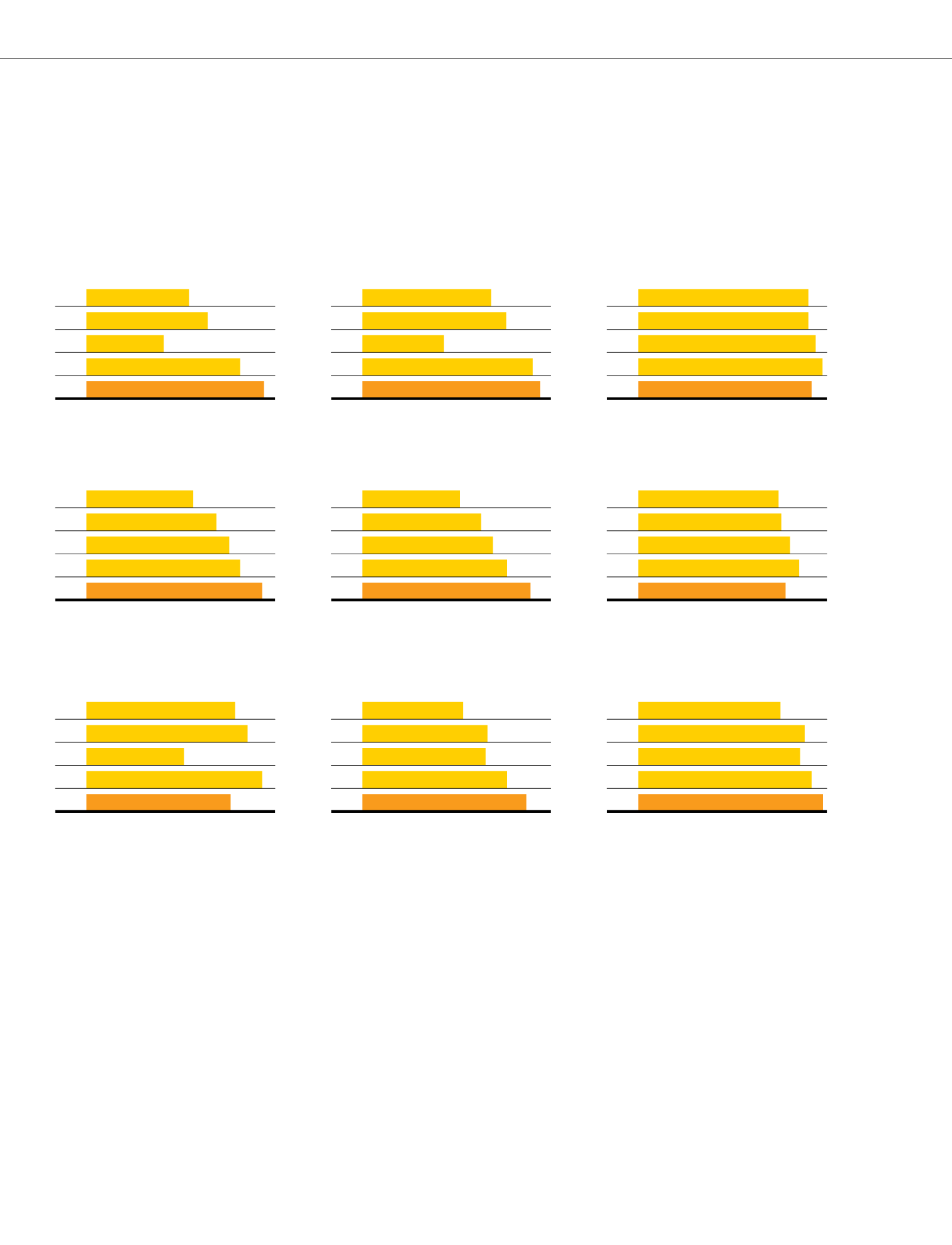

336.7

411.3

451.6

494.9

560.4

205.9

255.0

276.3

311.8

355.6

FY10

FY11

FP11 *

FY12

FY13

FY10

FY11

FP11 *

FY12

FY13

FY10

FY11

FP11 *

FY12

FY13

14.58

^

15.36

^

16.37

^

17.35

^

15.664

@

Total Assets

RM560.4 billion

Loans, Advances and Financing

RM355.6 billion

Capital Adequacy Ratio

Total Capital Ratio: 15.664%

@

FY10

FY11

FP11 *

FY12

FY13

FY10

FY11

FP11 *

FY12

FY13

FY10

FY11

FP11 *

FY12

FY13

55.0

60.0

36.0

65.0

53.5

53.5

66.9

65.5

77.6

88.1

7.56

8.94

8.58

9.20

9.94

Gross Dividend Per Share

53.5 sen

Market Capitalisation

RM88.1 billion

Share Price

RM9.94

* Six-month financial period (FP) ended 31 December 2011 due to the change of financial year (FY) end from 30 June to 31 December.

# Computed based on weighted reallocation of additional RM3.66 billion capital raised in October 2012.

^ RWCR and assuming full reinvestment of DRP.

@ Total Capital Ratio (TCR) is computed in accordance with Capital Adequacy Framework (Capital Components) issued by Bank Negara Malaysia on 28 November 2012.

we see sustainabilitydifferently

G4-17